In December 2021, a paper published by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research stated that despite having numerous benefits, certain new restrictions have been imposed on the banking of power of renewable energy (“RE”) which is expected to inhibit the growth of the rooftop and open-access solar market, and potentially slow progress towards India’s national target of 450 GW of installed renewable capacity by 2030.

Banking of power is a system in which a generating plant supplies power to the grid, without planning to sell it. Instead, the plant holds the option to draw back the power from the grid within a certain time and against the charges specified under relevant regulations. This concept was first introduced in Tamil Nadu in 1986 and its working is akin to a customer savings bank account.

Despite the above-mentioned benefits, over the last couple of years, governments are issuing restrictive banking notifications for renewable energy projects. Due to this, discoms are limiting their banking provisions considering the looming danger of losing high-ticket commercial and industrial clients to alternative RE power procurement models.

The Ministry of Power issued the Electricity (Promoting Renewable Energy through Green Energy Open Access) Rules which came into force in June 2022. The said rules allowed banking on a monthly basis only for open-access consumers. Moreover, the quantum of banked energy by the said consumers shall not exceed 10% of the total annual consumption of electricity from the distribution licensee by the consumers.

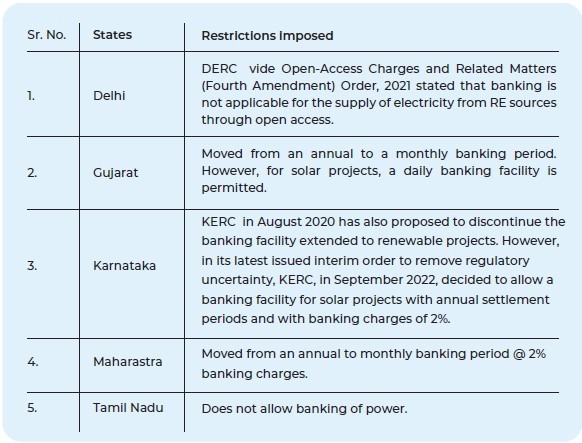

Certain RE-rich states (such as those included in the following table) have reduced the banking period from a year to a month, while others have completely withdrawn banking facilities for RE.

The rule-makers and discoms justify the new restrictions on the following grounds:

Although the points raised by discoms are valid, the national target of 450 GW GW of installed renewable capacity by 2030 seems far-fetched as it requires about INR 1.5 to 2 lakh crore annual investment whereas the actual investment in the renewable sector is estimated to be at a mere INR 75,000 crore.

Considering the gap in demand and supply, a committee of the Indian Parliament suggested the Federal Government consider imposing a “Renewable Finance Obligation for banks and financial institutions” to ensure the inflow of the requisite investment.[3] Certain other recommendations were made under the said report, as follows:

During peak summer and windy seasons, there is a high potential for excess RE generation which can later be utilised with the use of a banking facility. However, in the absence of the same and added restrictions on monthly banking of power, excess generation continues to remain underutilised. Thus, the Indian RE sector is faced with a major setback at such an early stage of its development.

As per the observations of the standing committee, the unique realities of the RE sector must be given due consideration while formulating a framework relating to financing and investments in the sector. Currently, RE projects are at the risk of being categorised as non-performing assets since revenue generation from RE is not uniform throughout the year considering its seasonality & intermittency.

Now, the RBI must consider lifting the INR 30 crore limit imposed on loans for RE projects since it is evidently not sufficient to fund mid and large-sized RE projects in India. An Energy Economist from the Institute for Energy Economics and Financial Analysis opined that as per the International Energy Agency’s India Energy Outlook 2021, India would require USD 110 billion annually to raise RE deployment, and network expansion which is three times the current annual investment i.e., USD 40 billion.[4]

************

Disclaimer: The content of this piece published by White & Brief Advocates & Solicitors is intended for informational purposes exclusively and is not intended to be a piece of legal advice on any subject matter. By viewing and reading the information, the reader understands there is no attorney-client relationship between the reader and the publisher. The contents of this informational piece shall not be used as a substitute for professional legal advice from a licensed attorney, and readers are encouraged to consult legal counsel on any specific legal questions they may have concerning a specific situation.

[1] Delhi Electricity Regulatory Commission

[2] Karnataka Electricity Regulatory Commission

[3] Standing Committee on Energy (2021-22), Seventeenth Lok Sabha, Ministry of New and Renewable Energy, Twenty First Report on Financial Constraints in Renewable Energy Sector, Available here.

[4] IEEFA: India Must Invest in Sustainable Energy Choices, Bloomberg Markets,