Prateek Bansal is a Partner at the Firm, where he heads the Taxation & Trade practice. Prateek is a qualified lawyer enrolled with the Bar Council of Maharashtra and Goa. With over 10 years of experience, Prateek’s area of expertise spans indirect taxes, including GST, Customs & Foreign Trade Policy, and erstwhile Service Tax, VAT and Central Excise. Prateek is actively engaged in providing advisory and litigation services to various Indian and Multinational clients, proficiently representing them in proceedings before various judicial and quasi-judicial forums. Prateek has assisted several clients in their informed adaption to the GST regime, and continues to diligently work with his client base on advisory and tax management consultations on a day-to-day basis. Additionally, Prateek is actively engaged in undertaking tax review and structuring exercises for his clients.

Prateek has also been a part of various advocacy related initiatives before various Government Authorities including the Ministry of Finance, and the Ministry of Commerce & Industries, in relation to various taxation and regulatory aspects.

In addition to indirect tax and customs, Prateek has been involved in a wide range of trade allied advisory services in niche areas of Legal Metrology, Consumer Protection, Drugs and Cosmetics, FSSAI law, and the Bureau of India Standards.

Prateek has advised and represented clients across a myriad of sectors, such as Real Estate, Entertainment, Hospitality, Healthcare, Pharmaceuticals and Chemicals, Gems & Jewellery, Food Processing and Retail, among others.

Prior to joining the Firm, Prateek was a part of the tax team at Economic Laws Practice, Mumbai.

Indicative Experience

GST Implementation

Assisted, advised and provided handholding support to various leading companies engaged in sectors including real estate, media and entertainment, hospitality, and food processing in transitioning to the GST regime.

Government Advocacy Under GST

- Assisted and represented Industry Associations engaged in sectors such as media, entertainment and hospitality amongst others in making representations to the Ministry of Finance (India) and GST Council for lower/ benign GST rates.

- Successfully provided advocacy to the multiplexes and cinema owner’s associations in representations before various State Government authorities for the grandfathering of exemptions/ rebates under GST regime.

- Assisting and advising Industry Associations engaged in sectors such as pharmaceuticals and Infrastructure in preparation / computation of data to be furnished to Remission of Duties and Taxes on Export Products (‘RODTEP’) Committee and representing such aggrieved associations before the RODTEP Committee and Central Board of Indirect Taxes and Customs (CBIC).

Ongoing Support Under GST

Providing ongoing assistance and tax advisory to leading companies engaged in sectors such as organizing sporting events, pharmaceuticals and chemicals,etc.

Litigation Under GST And State Levies

- Advising and representing a real estate company in anti-profiteering writ proceedings before the Hon’ble Delhi High Court.

- Advising and representing a renowned cricket league franchise before the GST authorities of two Indian States in a dispute relating to appropriate place of GST registration and on the issue of reversal of input tax credit pertaining to supply of services liable to GST on reverse charge basis.

- Counselling clients in challenging the budgetary support scheme under GST which is issued in lieu of are based exemptions available under the erstwhile indirect tax regime .

Erstwhile Indirect Taxation Regime

- Handling litigation matters pertaining to the erstwhile indirect taxes regime including but not limited to drafting and filing of statutory correspondences, filing appeals before the Customs, Excise and Service Tax Appellate Tribunal (‘CESTAT’) and writ petitions with various High Courts.

- Advising, representing and providing strategic counsel to leading pharmaceuticals and food processing companies in various issues under Value Added Tax and Central Sales Tax, including disallowance of branch transfers in origin States and refund / set-off from the destination States.

- Advised and represented a leading cricket league franchisee and media & entertainment company regarding levy of Service Tax on revenue-sharing arrangement before adjudicating authority and CESTAT.

- Advised and represented a multinational chemicals company before adjudicating authority and CESTAT regarding reversal of CENVAT Credit availed in relation to input services utilized for trading activity and taxable output services.

Customs & Foreign Trade Policy

- Effectively undertook comprehensive review of customs classification of products imported and exported by a leading pharmaceutical company.

- Handling litigation proceedings of various leading pharmaceuticals and chemicals companies before the Customs authorities in issues pertaining to violation of ‘pre-import’ condition for availing IGST exemption against Advance Authorization license.

Legal Metrology

Represented a leading multinational retail corporation in a high-stakes dispute involving allegations of non-compliance under the Legal Metrology Act. Successfully navigated complex regulatory investigations and proceedings, effectively mitigating potential penalties and reputational risks.

Startup

Advised a high-growth technology startup on structuring its cross-border operations, efficiently navigating complex tax implications, customs duties, and international trade regulations. Provided strategic counsel on optimizing tax structures, compliance with customs valuation rules, and leveraging trade agreements to significantly reduce operational costs.

Related Experts

Kanan Chawda

Mohit Bakshi

Nilesh Tribhuvann

Prateek Bansal is a Partner at the Firm, where he heads the Taxation & Trade practice. Prateek is a qualified lawyer enrolled with the Bar Council of Maharashtra and Goa. With over 10 years of experience, Prateek’s area of expertise spans indirect taxes, including GST, Customs & Foreign Trade Policy, and erstwhile Service Tax, VAT and Central Excise. Prateek is actively engaged in providing advisory and litigation services to various Indian and Multinational clients, proficiently representing them in proceedings before various judicial and quasi-judicial forums. Prateek has assisted several clients in their informed adaption to the GST regime, and continues to diligently work with his client base on advisory and tax management consultations on a day-to-day basis. Additionally, Prateek is actively engaged in undertaking tax review and structuring exercises for his clients.

Prateek has also been a part of various advocacy related initiatives before various Government Authorities including the Ministry of Finance, and the Ministry of Commerce & Industries, in relation to various taxation and regulatory aspects.

In addition to indirect tax and customs, Prateek has been involved in a wide range of trade allied advisory services in niche areas of Legal Metrology, Consumer Protection, Drugs and Cosmetics, FSSAI law, and the Bureau of India Standards.

Prateek has advised and represented clients across a myriad of sectors, such as Real Estate, Entertainment, Hospitality, Healthcare, Pharmaceuticals and Chemicals, Gems & Jewellery, Food Processing and Retail, among others.

Prior to joining the Firm, Prateek was a part of the tax team at Economic Laws Practice, Mumbai.

In The Media

The 10th Annual Real Estate & Construction Legal Summit 2024

White & Brief – Advocates and Solicitors on NDTVIndia Global

Indian Quality Control Orders a Cause of Concern for ASEAN

Tariff rationalisation and its impact on India’s supply chain and trade efficiency

CBIC’s GST compliance reforms can ease startup woes, rein in officer discretion, say experts

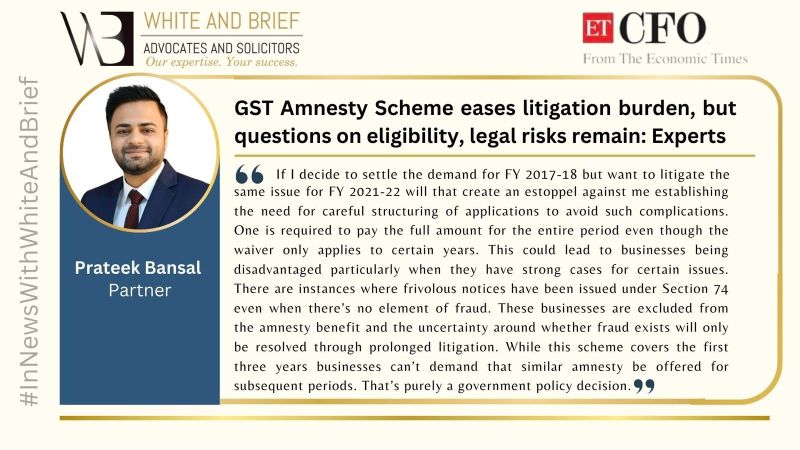

GST Amnesty Scheme eases litigation burden, but questions on eligibility, legal risks remain: Experts

Our Partner, Mr. Prateek Bansal was invited by Lex Witness – India’s 1st Magazine on Legal & Corporate Affairs as a distinguished speaker

𝑻𝒉𝒆 𝑫𝒐𝒎𝒊𝒏𝒐 𝑬𝒇𝒇𝒆𝒄𝒕: 𝑯𝒐𝒘 𝑬𝑫 𝑰𝒏𝒗𝒆𝒔𝒕𝒊𝒈𝒂𝒕𝒊𝒐𝒏𝒔 𝑶𝒑𝒆𝒏 𝒕𝒉𝒆 𝑭𝒍𝒐𝒐𝒅𝒈𝒂𝒕𝒆 𝒇𝒐𝒓 𝑻𝒂𝒙 𝑰𝒏𝒗𝒆𝒔𝒕𝒊𝒈𝒂𝒕𝒊𝒐𝒏𝒔

Mr. Prateek Bansal graced the 𝟭𝟬𝘁𝗵 𝗔𝗻𝗻𝘂𝗮𝗹 𝗥𝗲𝗮𝗹 𝗘𝘀𝘁𝗮𝘁𝗲 & 𝗖𝗼𝗻𝘀𝘁𝗿𝘂𝗰𝘁𝗶𝗼𝗻 𝗟𝗲𝗴𝗮𝗹 𝗦𝘂𝗺𝗺𝗶𝘁, 𝟮𝟬𝟮𝟰

GST Rate Rationalisation May See Further Delay

GST Rate Rationalisation Gets Tricky for NDA 3.0.

Experts welcome GST anti-profiteering revamp but warn on consumer protection and ongoing litigation

Budget 2024: What Salaried Employees Can Expect from FM Nirmala Sitharaman

Budget 2024: Govt hikes monetary limits for filing tax appeals

LIVE on Budget 2024 – White & Brief – Advocates and Solicitors is delighted to share a glimpse of the Budget 2024 discussions on CNN-News18.

GSTN rolls out Invoice Management System to address excess ITC claims issue; seek clarity on legal validity, integration.

Edible oil or cosmetic? Small coconut oil packs pose a big tax question.

GST Council Clarifies Valuation Rules For Import Of Services By Related Entities With Full Input Tax Credit.

I-T Portal Glitches Persist, CAs Express ‘Dismay

Our Tax Partner, Prateek Bansal shared his views with One Nation, Three Tax Options; Is This A Budget For Salaried Class?

In the continuation of a series of special episodes, here’s another participation by our Tax Partner, Prateek Bansal, on CNBC_Awaaz, anchored by Neeraj Bajpai.

Prateek Bansal, 𝗣𝗮𝗿𝘁𝗻𝗲𝗿, White & Brief – Advocates and Solicitors is a Grand Master.

Mr. Prateek Bansal was a distinguished speaker at the Grand Masters 2024 Summit

Amendment in Section 140(7) of the CGST Act: Transitional Credit for Input Service Distributors

Infosys May Not Be Liable for Rs 32,000 Crore GST Demand — Here’s Why.

GST rate rationalisation : Experts suggests shift to three-tier structure to simply compliance.

GST Compensation Cess: Experts call for Gradual phase-out, seek long-term tax reforms.

Taxability Of Loans Between Related Persons Or Group Companies – Impact Assessment W.r.t. 53rd GST Council Meeting.

Our Partner Prateek Bansal article has been published in ETLegalWorld offering deep insights into the GST demands facing the IT industry

Tax reforms in 100-days: Simplification, ease of compliance, key themes

Three- tier GST rate up for debate ; maintaining revenue-neutrality a challenge , say experts

Zomato’s Rs 803 Crore GST Demand Sparkd Renewed Debate on E-commerce Taxation.

What is standard deduction in income tax and who is eligible.

Women, SC/STs entrepreneurs can now get up to Rs 2 crore loan.

New IT bill allows officers to access your social media, email accounts if tax evasion suspected

GST Rate Rationalisation: Examining India’s Current Framework and Decoding Challenges

Here’s what to expect for commercial real estate market.

Union Budget 2025 Income Tax Live Updates

A delegation of MDs and CEOs from Furniture Manufacturing Industry, led by our Partner Mr. Prateek Bansal met Mr. Piyush Goyal Hon’ble Minister of Commerce & Industry, Government of India in New Delhi.

HAL, BEL , BDL, Mazagon Dock, Cochin Shipyard, GRSE shares : Budget 2025 expectations.

In an exclusive conversation with CNBC-TV18 our Tax Partner Mr. Prateek Bansal.

GST Outlook 2025: Tribunals, easing compliance, rate rationalisation expected in New Year

GST and Production Linked Incentive (PLI) Scheme: Understanding the Tax Compliance Nexus